By Jacqueline Dooley | July 24, 2019

Competitive intelligence is a valuable digital marketing tool. More than 90% of Fortune 500 companies practice competitive intelligence, with over 70% of businesses investing more than 20% of their overall technology budgets into intelligence and data analytics.

You may think your organization is too busy or too small to practice competitive intelligence, but we’re here to tell you that you can glean a wealth of valuable information about your competitors without a large investment of time or money.

In this post, we’ll review some of the key low (or no) cost techniques we use when conducting online competitive intelligence including some recommendations for tools that can help you understand what your competitors are doing online and how this knowledge can inform your own digital marketing strategy.

Know Thy Enemy

Okay, maybe your competitors aren’t exactly your enemies, but when conducting cyber espionage, it’s helpful to set the appropriate mood. Thus, before you embark on any sort of competitive intelligence undertaking, it’s helpful to have a clear picture of who your competitors are.

Start with the usual suspects – those companies that directly compete with you for market share and customers. It may be a long list, so you’ll want to narrow it down to the top four or five companies.

Once you have that list, you should move onto indirect competitors because in the online space, obvious competitors aren’t necessarily the only threat. If you’re advertising on Google, for example, then anyone bidding on your targeted keywords is a competitor in the sense that they may be diverting traffic from your site to theirs.

Once you have a solid list of competitors in place, you can begin the process of gaining competitive intelligence using the tools and techniques we’ve outlined below.

Competitive Intelligence Tools

MarTech, short for “Marketing Technology,” is a flourishing industry worth an estimated 99.9 billion dollars globally. MarTech covers a wide range of categories that include the following, as identified by MarTech Today:

- Advertising & Promotion

- Content & Experience

- Social & Relationships

- Commerce & Sales Data

- Project & Workflow Management

Cloud-based tools and software make up the foundation of MarTech. This includes many products that you’re likely familiar with – from HubSpot to Adobe to Yoast, there’s a technology out there for just about every digital marketing need. When diving into the online competitive landscape, we love competitive keyword tools.

Keyword Research and Ad Spying

Keyword research tools enable users to gain an understanding about what keywords their competitors are bidding on, how much they’re paying for their search ads, and what their ad copy looks like. This is a great way to understand what incentives your competitors are offering. Many keyword tools enable subscribers to monitor the organic search positioning for their own website, as well as competitors’ websites, for a given keyword.

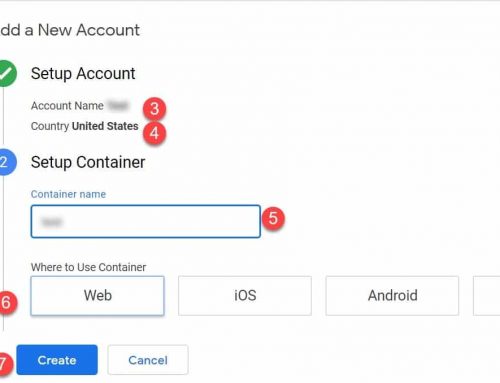

For as little as $33/month, SpyFu provides users with detailed information on competitors’ search strategy.

SpyFu’s online dashboard

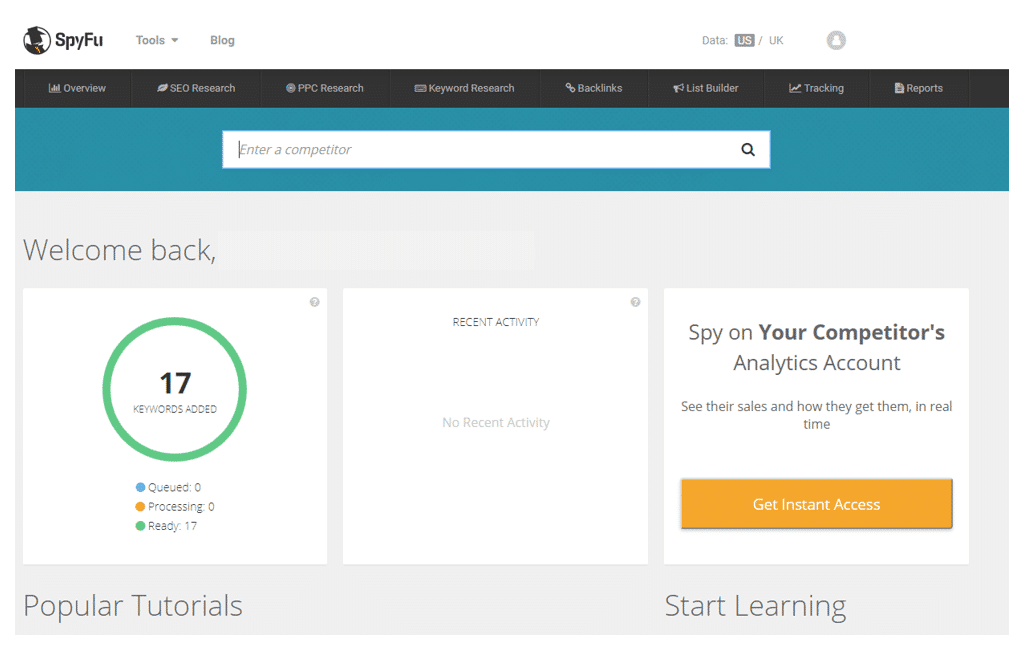

SpyFu is easy to use and intuitive. Its features are too numerous to list, but a good place to start is with the Keyword Research tab. Click on that then do a search for your most desirable keyword to see monthly search volume, ranking difficulty, average cost per click, and more.

Image Source: SpyFu

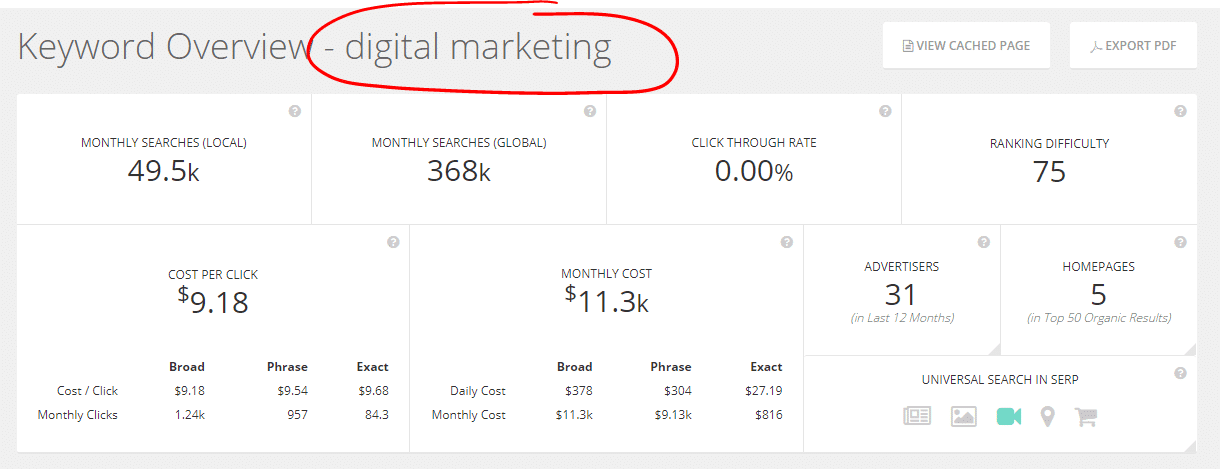

Scroll down to see a list of top advertisers for the given keyword along with their best ads. You can also see the organic ranking history for multiple websites.

Image Source: SpyFu

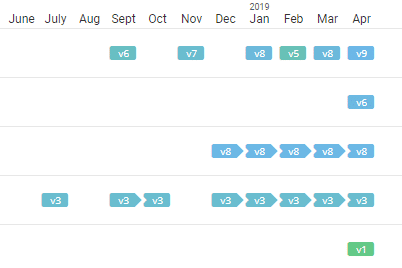

One interesting feature from the above view is the timeline of ads each domain has run over a twelve-month period (shown at right). Here is a detail of that section:

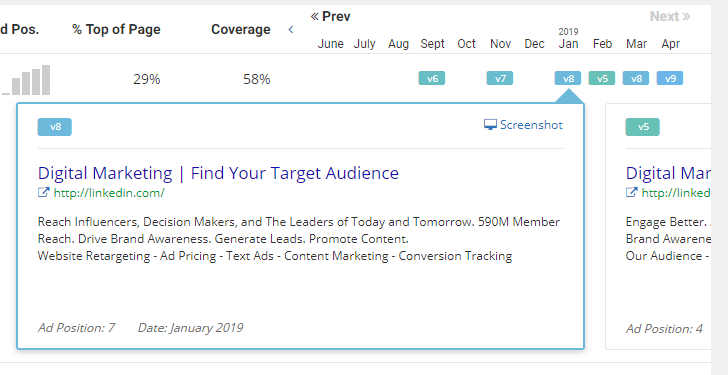

If you hover over the ad version (e.g., v3, v8, etc.), you can see the top ad that ran during a given month for a given domain.

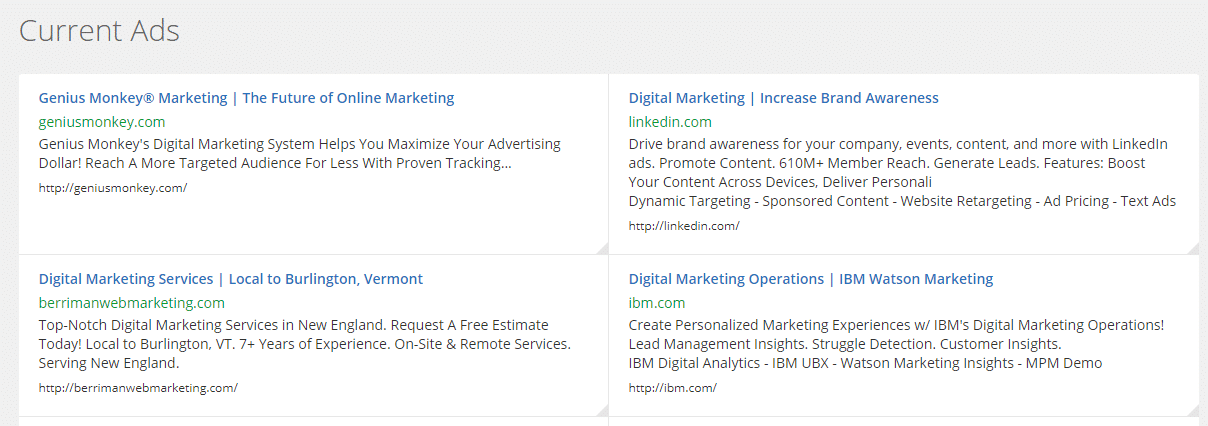

You can also see a list of current ads for the given keyword (in this case, “digital marketing”).

Image Source: SpyFu

SEMrush starts at $100/month and offers similar competitive information as SpyFu, providing data on competitors’ strategies in display advertising, paid and organic search, and link building.

One differentiating feature of SEMrush is the Display Advertising tool, which enables users to analyze text and banner ads on websites throughout the Internet. This is a great feature that helps users go beyond search ads to give them a better perspective of what a given advertiser’s digital marketing strategy looks like. Users can input a domain (e.g., Bouqs.com) or a keyword (e.g., “order flowers online”).

Bouqs ads taken from SEMrush’s Display Advertising tool

The benefit of seeing a competitor’s ad is that you can get a glimpse into their current marketing strategy. In the above example, Bouqs was offering 15% off and free weekday delivery as a double incentive in one ad and just free delivery in the other.

Using either SpyFu or SEMrush for competitor keyword research and ad syping should suffice.

Industry Trends

There are several resources online that can help you establish trends in a given industry. One of our favorites is Google Trends.

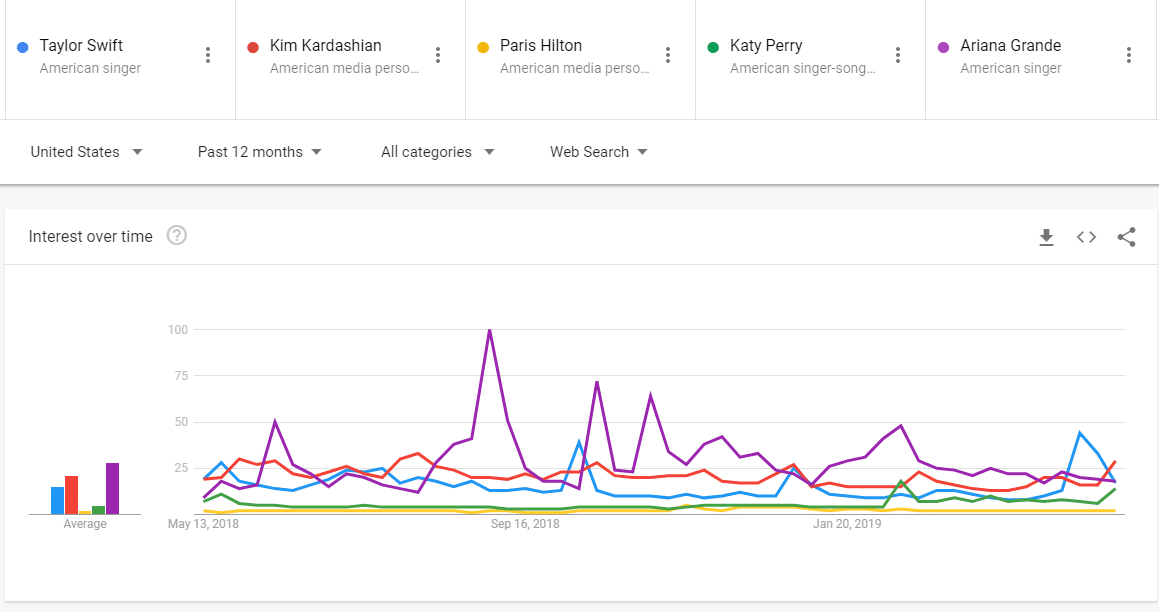

Google Trends analyzes the popularity of top search queries in Google Search for various regions and languages, using graphs and charts to help visualize trend data.

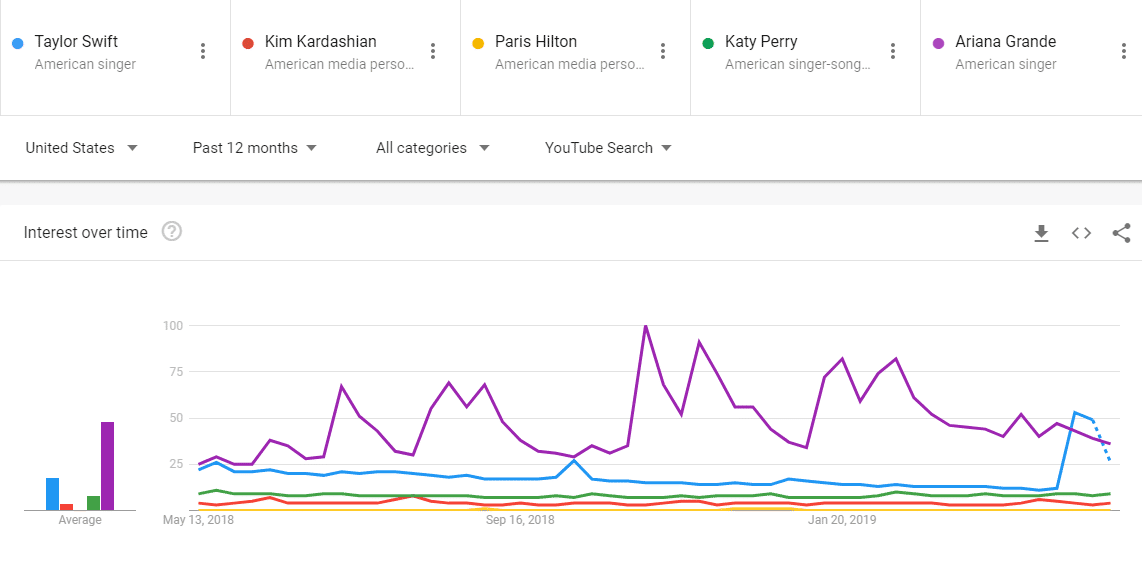

Users can compare up to five different keywords over time – from 7 days to up to 15 years (though most data doesn’t go that far back). Here is a comparison of celebrity name searches over the past 12 months (it’s Ariana Grande for the win).

Users can drill down by search type including web search, image search, news search and YouTube search.

Here’s what the above comparison looks like when we switch it to YouTube search (still Ariana Grande by a long shot).

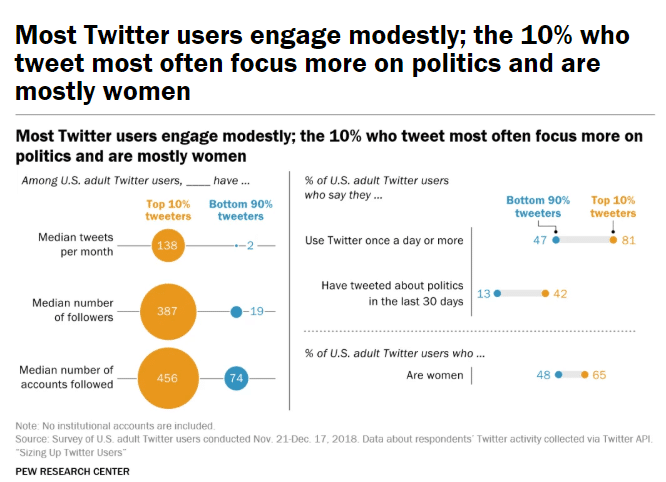

The Pew Research Center is also a great resource to find industry trends. Pew’s data is free, but it’s not always possible to find recent reports in specific industries. It is, however, particularly useful for gleaning broad behavioral trends on Americans’ Internet usage such as social media and device usage, smartphones versus tablets, and the makeup and behavior of various audiences such as Twitter users.

Image Source: Pew Research Center

WordStream, HubSpot, and other niche sites can be great resources if you’re digging for industry-specific data that you don’t want to pay for, like the average search ad CTR for the Finance and Insurance industry (it’s 4.5%).

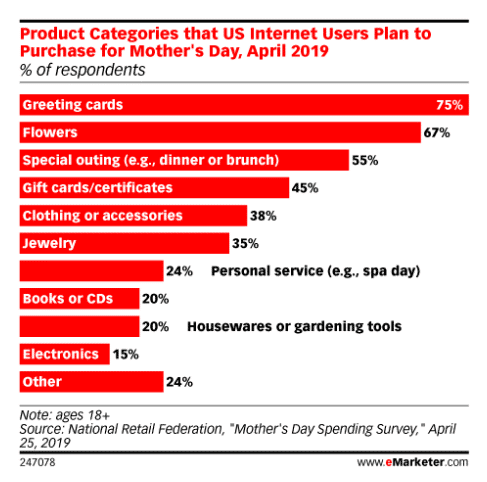

Chances are, if you want detailed information about a specific industry, you’ll need to pay for it. Examples of websites that provide this kind of data include eMarketer and Forrester Research. However, if your research budget isn’t that robust, you can often find a few free data points from either of these websites.

eMarketer has an Articles section with a wealth of free information in the form of articles, podcasts, and charts. For example, the following chart illustrates what items that Internet users intend to purchase on Mother’s Day.

Image Source: eMarketer

Putting It All Together

Once you’ve completed the legwork of gathering competitive Intelligence, it can be helpful to have a strategy for putting it all together. Here’s a four-step approach to synthesizing all that data.

Stay Focused – Keep only the research that ties directly back to your digital marketing goals and disregard the rest. For example, if you intend to run ads only on Twitter and LinkedIn, then you don’t necessarily need to know what people are doing on YouTube. The same is true when you’re parsing through all that competitor information. Stick with the competitors you want to emulate and discard the rest.

Keep it Visual – Whenever possible, turn your data Into charts and graphs so that you can easily visualize trends. Google Trends offers up the perfect example of how the simplicity how a line chart can help you understand competitive activity quickly.

Make it Actionable – Data is useless unless it can be applied to an actionable strategy. For example, if you’ve learned that the majority of Twitter users are Democrats and you’re putting a plan together for a Republican campaign, you may want to rethink where you place your ads.

Combine Keywords & Ads – Use competitor tools to find the keywords your competitors are advertising for, which might be good opportunities for you, but also combine that knowledge with the ad copy and offers they are running. When you see a competitor running the same ad for the same keyword over a long stretch of time, it’s likely a sign they are having success with that combination.

Conclusion

Each nugget of information that you obtain through your online research has the potential to help you formulate your next steps. The trick to turning competitive intelligence into an actionable digital marketing strategy, is to synthesize the information in a way that ties to your specific goals.